davis county utah sales tax rate

The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. May 17th 2023 1000 am - Pre-registration starts at 900 am.

Utah Find A Local Easter Egg Hunt In Utah

2020 rates included for use while preparing your income tax deduction.

. To review the rules in Utah visit our state-by-state. The Davis County sales tax rate is. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729.

The latest sales tax rates for cities in Utah UT state. There is no applicable city tax. The Utah state sales tax rate is currently.

Davis County collects on average 06 of a propertys assessed fair market. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. We hope you have done your research before coming to the sale as all sales are final.

Utah also establishes guidelines that. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Rates include state county and city taxes.

The 2023 Davis County Delinquent Tax Sale will be held. To find out the amount of all taxes and fees for your. The most populous location in Davis County Utah is Layton.

Average Property Tax Rate in Davis County. Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of April. The sales tax jurisdiction name.

The 725 sales tax rate in Bountiful consists of 48499 Utah state sales tax 18 Davis County sales tax and 06 Special tax. The 2018 United States Supreme Court decision in South Dakota v. Davis County Treasurer encourages efforts to maintain critical government services AND to protect the health of the public and our employees.

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate between all of them is 724. As far as all cities towns and locations go the place with the.

Davis County Admin Building 61 South Main Street Farmington Utah 84025. 271 rows 2022 List of Utah Local Sales Tax Rates. Average Sales Tax With Local.

MAILING Davis County ClerkAuditor PO. The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax also known as real estate tax in Davis County is 135400 per year based on a median home value of 22440000 and a median effective.

Real estate assessments are undertaken by the county. Davis County UT Sales Tax. Has impacted many state nexus laws and sales tax collection requirements.

This rate includes any state county city and local sales taxes. The 745 sales tax rate in Hill Afb consists of 48499 Utah state sales tax 165 Davis County sales tax 02 Hill Afb tax and 075 Special tax. Farmington Utah 84025 Mailing Address Davis County Treasurer PO.

Davis County Administration Building Room 131. Utah has a 485 sales tax and Davis County collects an additional 18. Utah has state sales.

See Publication 25 Sales and Use Tax General Information. Box 618 Farmington Utah 84025 801 451. 7705 or email to.

93 rows This page lists the various sales use tax rates effective throughout Utah. Based on latest data from the US Census Bureau. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT.

UT Rates Calculator Table. M - F 8am to 5pm. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax.

The sales tax jurisdiction name is Riverdale. We encourage payment of.

Utah Government And Society Britannica

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

Property Taxes Are Doubling In Three Utah Cities And Rising In 56 Areas Mostly To Pay For Teachers Police And Firefighters

Truth In Taxation 2022 Centerville Ut

Davis School District Home Facebook

Davis County Party Utah Democrats

Utah Centennial County History Series Davis County 1999 By Utah State History Issuu

North Davis Utah Ut 84041 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

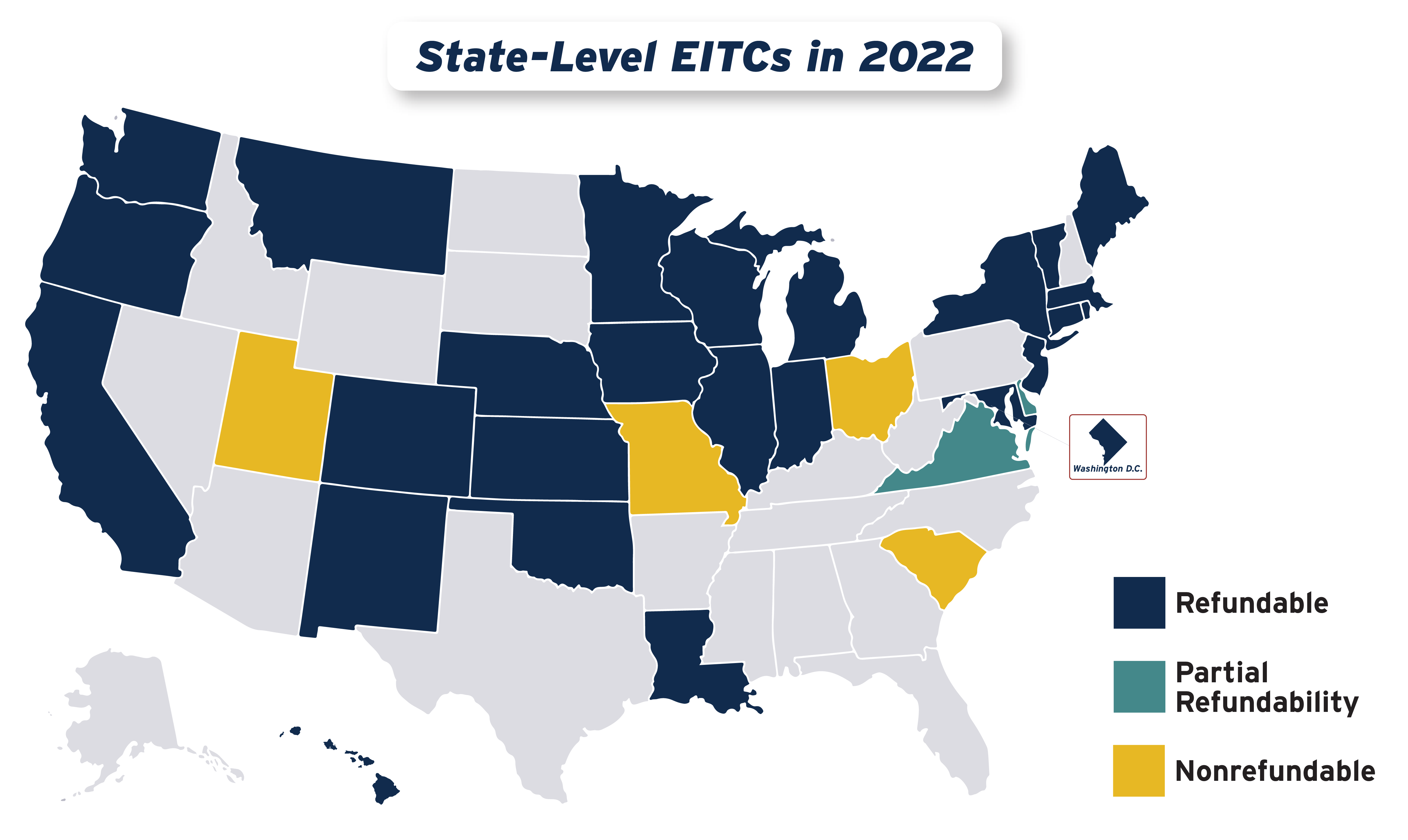

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

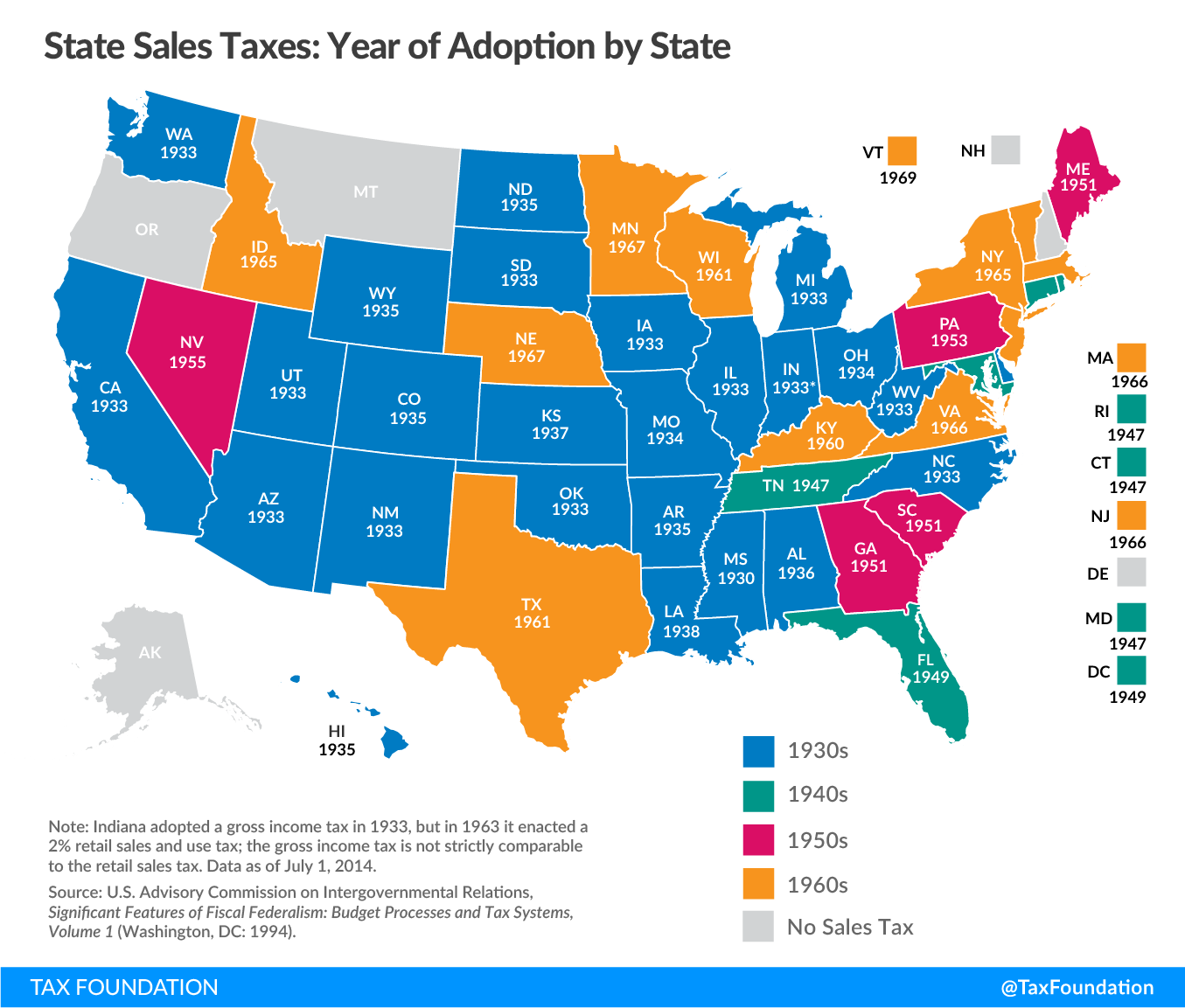

Sales Taxes In The United States Wikipedia

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Utah Sales Tax Calculator And Local Rates 2021 Wise

Tax Rate Proposal Davis School District

Utah Tax Rates Rankings Utah State Taxes Tax Foundation